Life Insurance in and around San Francisco

Insurance that helps life's moments move on

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

It's Never Too Soon For Life Insurance

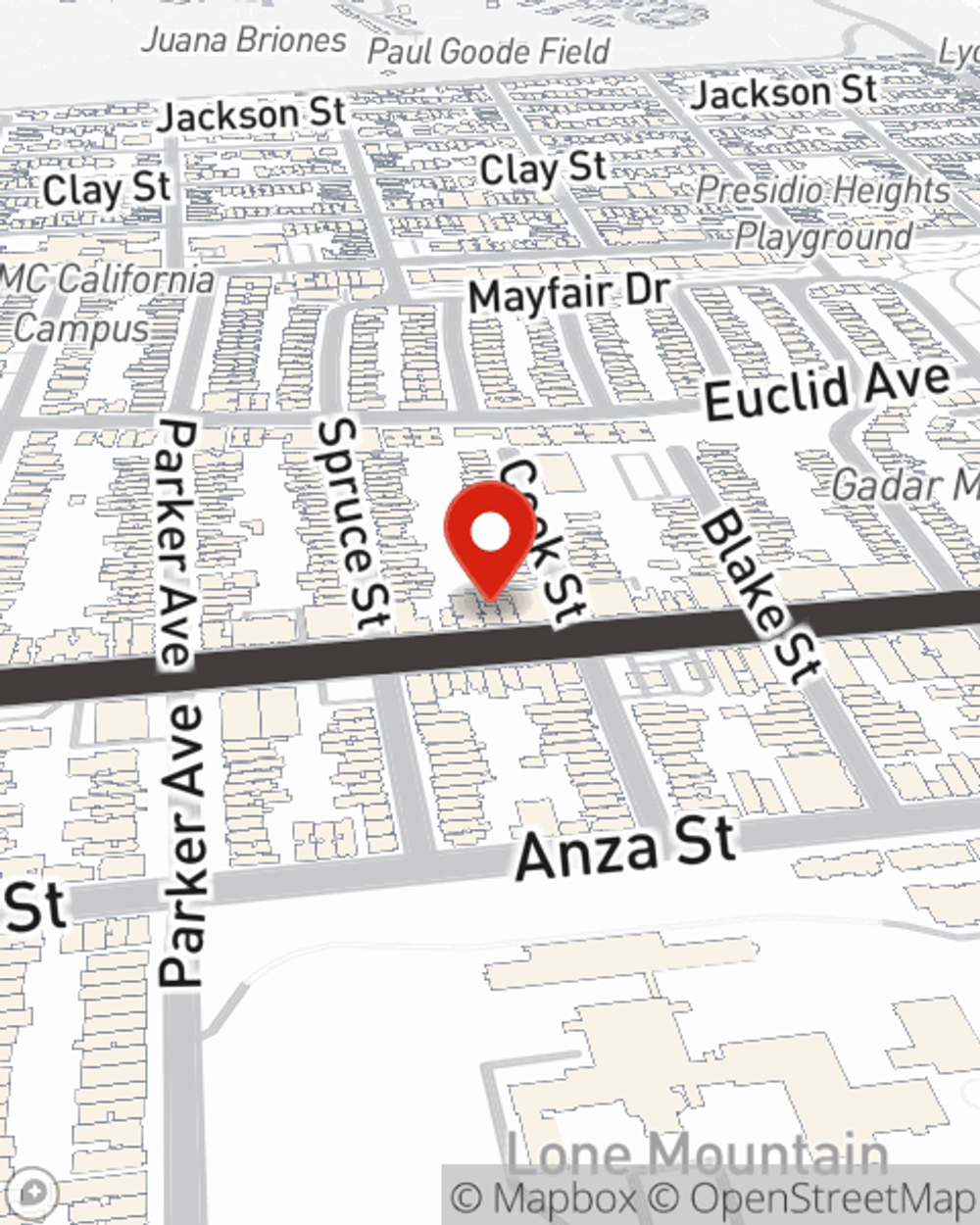

Think you are too young for life insurance? Actually, it’s the opposite! It’s much better to secure your life insurance in your 20s and 30s. That’s why your San Francisco, CA, friends and neighbors of all ages already have State Farm life insurance!

Insurance that helps life's moments move on

Now is the right time to think about life insurance

Agent Kajal Pashmi, At Your Service

Life can be just as unexpected when you're young as when you get older. That's why there's no time like the present to get Life insurance and why State Farm offers multiple coverage options. Whether you're looking for coverage for a specific number of years or coverage for a specific time frame, State Farm can help you choose the right policy for you.

Did you know that there's now a life insurance option available that's perfect for someone who thought they couldn't qualify? It's called Guaranteed Issue Final Expense and it can really be helpful when it comes to supplement the financial options for final expenses like medical bills or funeral costs. Don't let these expenses be a burden on your loved ones in the future - check out State Farm Guaranteed Issue Final expense from State Farm agent Kajal Pashmi for help with all your life insurance needs

Have More Questions About Life Insurance?

Call Kajal at (415) 742-4459 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.

Kajal Pashmi

State Farm® Insurance AgentSimple Insights®

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.